Retirement is one of the most important life goals, yet many people fail to prepare for it properly. Financial planning for retirement is not just about saving money; it is about using the right tools to manage income, expenses, investments, risks, and future needs. Financial planning tools for retirement help individuals make informed decisions, track progress, and ensure long-term financial security. With proper tools, retirement planning becomes more structured, realistic, and achievable.

This article explores the most important financial planning tools for retirement, their benefits, and how they help individuals build a stable and comfortable post-retirement life.

Understanding Retirement Financial Planning

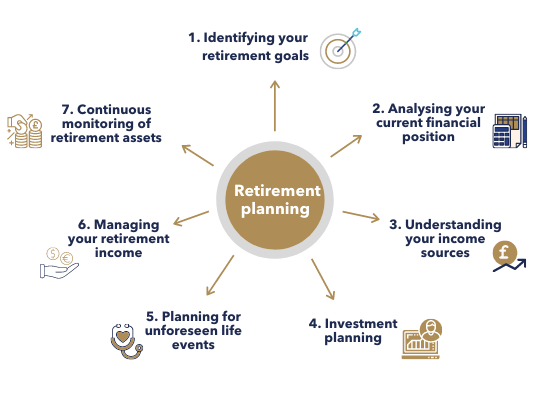

Retirement financial planning is the process of estimating future financial needs and creating a strategy to meet them after active employment ends. It involves setting retirement goals, calculating required savings, choosing suitable investments, managing risks, and planning withdrawals.

Financial planning tools simplify this process by providing calculations, projections, and insights that help people avoid guesswork. These tools are useful for individuals at every stage of life, whether they are just starting their careers or approaching retirement age.

Retirement Goal Planning Tools

One of the most essential tools in retirement planning is goal-setting software or frameworks. These tools help individuals define clear retirement objectives such as desired retirement age, lifestyle expectations, travel plans, healthcare needs, and legacy goals.

By identifying these goals early, individuals can estimate how much money they will need during retirement. Goal planning tools also allow adjustments as circumstances change, such as career growth, family responsibilities, or economic conditions. Clear goals provide direction and motivation to stay committed to long-term financial plans.

Retirement Savings Calculators

Retirement savings calculators are among the most commonly used financial planning tools. They estimate how much money an individual needs to save to maintain their desired lifestyle after retirement.

These calculators consider factors such as:

- Current age and planned retirement age

- Expected lifespan

- Current savings

- Monthly or annual contributions

- Expected investment returns

- Inflation rate

By using retirement savings calculators, individuals can determine whether their current savings strategy is sufficient or needs improvement. These tools highlight potential shortfalls and encourage proactive adjustments, such as increasing contributions or changing investment strategies.

Budgeting Tools for Retirement Planning

Budgeting tools play a crucial role in retirement financial planning. They help individuals track income, expenses, and savings throughout their working years and during retirement.

Before retirement, budgeting tools help control spending and increase savings capacity. After retirement, they help manage fixed income sources such as pensions or savings withdrawals. Budgeting tools also allow retirees to plan for irregular expenses, including healthcare costs, travel, and home maintenance.

A well-structured budget ensures that retirees do not outlive their savings and can maintain financial independence.

Investment Planning Tools

Investment planning tools are critical for growing retirement savings over time. These tools help individuals choose suitable investment options based on their risk tolerance, time horizon, and financial goals.

Common investment planning tools include:

- Asset allocation models

- Risk assessment questionnaires

- Portfolio diversification tools

- Return projection tools

These tools help balance growth and stability by spreading investments across different asset classes. They also help individuals understand market risks and adjust portfolios as retirement approaches. Proper investment planning reduces uncertainty and increases the likelihood of meeting retirement goals.

Risk Management and Insurance Planning Tools

Retirement planning is incomplete without risk management. Financial planning tools help individuals identify potential risks that could affect their retirement savings, such as medical emergencies, disability, or long-term care needs.

Insurance planning tools assist in evaluating coverage options for health, life, and long-term care insurance. They help determine appropriate coverage levels and estimate future healthcare expenses. Managing these risks protects retirement savings from unexpected financial shocks and ensures peace of mind during retirement years.

Tax Planning Tools for Retirement

Tax planning tools are essential for maximizing retirement income. Taxes can significantly reduce retirement savings if not managed properly. These tools help individuals understand how different income sources are taxed and how withdrawals affect tax liabilities.

Tax planning tools assist with:

- Estimating retirement tax obligations

- Planning tax-efficient withdrawals

- Managing taxable and tax-advantaged accounts

- Reducing unnecessary tax burdens

Effective tax planning ensures retirees keep more of their savings and avoid surprises during retirement.

Retirement Income Planning Tools

Retirement income planning tools help convert accumulated savings into sustainable income streams. These tools estimate how long savings will last based on withdrawal rates, investment returns, and life expectancy.

They help retirees decide:

- How much to withdraw annually

- Which accounts to withdraw from first

- How to balance income and preservation of capital

Income planning tools also help manage longevity risk, ensuring retirees do not run out of money during their lifetime. They provide confidence and stability in retirement income strategies.

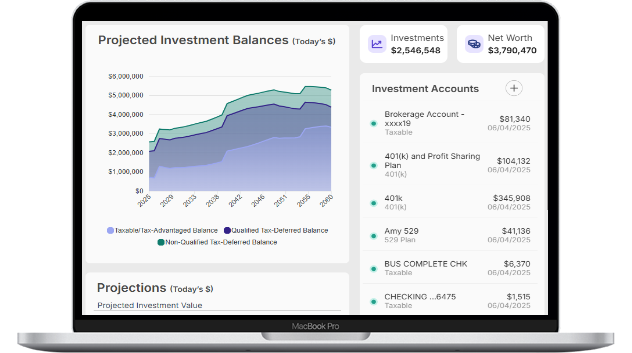

Cash Flow Projection Tools

Cash flow projection tools are advanced financial planning tools that forecast future income and expenses over time. These tools help individuals visualize how their financial situation will change throughout retirement.

By projecting cash flows, individuals can identify periods of surplus or shortfall and plan accordingly. Cash flow tools are particularly useful for retirees with multiple income sources or varying expenses. They help maintain financial discipline and long-term sustainability.

Estate Planning Tools

Estate planning tools are often overlooked but are a vital part of retirement financial planning. These tools help individuals plan how their assets will be distributed after death.

They assist with:

- Asset documentation

- Beneficiary planning

- Legacy goals

- Minimizing legal and financial complications

Estate planning tools ensure that retirees’ wishes are respected and that their loved ones are financially protected.

Benefits of Using Financial Planning Tools for Retirement

Using financial planning tools offers several advantages:

- Improved financial clarity and control

- Better decision-making based on data

- Early identification of financial gaps

- Reduced stress and uncertainty

- Increased confidence in retirement readiness

These tools turn complex financial concepts into understandable and actionable plans.

Choosing the Right Financial Planning Tools

Selecting the right financial planning tools depends on individual needs, financial knowledge, and life stage. Beginners may benefit from basic calculators and budgeting tools, while experienced investors may require advanced investment and tax planning tools.

Consistency is more important than complexity. Using a few reliable tools regularly is better than using many tools occasionally. Financial planning is an ongoing process, and tools should be reviewed and updated as circumstances change.

The Role of Discipline and Commitment

While financial planning tools are powerful, they are only effective when combined with discipline and commitment. Tools provide guidance, but success depends on consistent saving, smart spending, and long-term focus.

Individuals must regularly monitor progress, adjust plans, and stay informed. Retirement planning is not a one-time task but a lifelong journey.

Conclusion

Financial planning tools for retirement play a vital role in helping individuals achieve financial security and independence in later life. From goal setting and savings calculators to investment planning, risk management, and income projection tools, each tool serves a specific purpose in building a comprehensive retirement strategy.

Using these tools allows individuals to plan with confidence, reduce uncertainty, and make informed financial decisions. Retirement may seem far away, but early and effective planning ensures a comfortable and stress-free future. With the right financial planning tools and a disciplined approach, anyone can turn retirement dreams into reality.