Budgeting is one of the most essential skills for managing personal finances effectively. At its core, budgeting is the process of planning how to spend and save your income so that you can meet your financial goals, handle unexpected expenses, and maintain financial stability. Whether you are an individual managing a monthly salary or a household coordinating multiple incomes, budgeting helps you gain control over your money and make informed decisions.

Understanding Budgeting

Budgeting is more than just tracking what you spend. It is a proactive approach to financial management. By creating a budget, you can allocate your income to cover necessary expenses, savings, investments, and discretionary spending. A well-structured budget ensures that you do not overspend, reduces financial stress, and enables you to plan for future goals, whether buying a home, starting a business, or preparing for retirement.

There are several key components of budgeting:

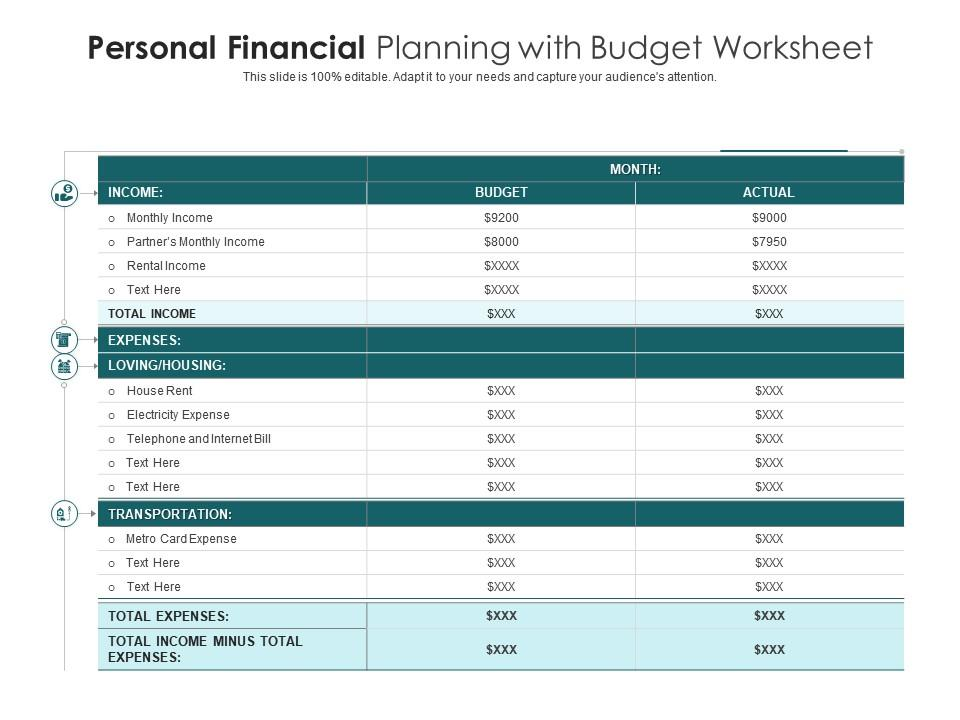

- Income: This includes all sources of money coming in, such as salaries, business income, freelance earnings, or investment returns. Accurately calculating your income is the foundation of a successful budget.

- Expenses: Expenses are the costs you incur, both fixed and variable. Fixed expenses are regular and predictable, such as rent, mortgage, or loan payments. Variable expenses fluctuate, like grocery bills, entertainment, and utility costs.

- Savings and Investments: Part of budgeting is setting aside money for savings and investments. This ensures long-term financial security and allows you to grow wealth over time.

- Debt Repayment: Budgeting helps manage existing debts by allocating money for timely repayments, reducing interest, and avoiding penalties.

Why Budgeting is Important

Budgeting is critical for several reasons:

- Financial Awareness: A budget provides a clear picture of how your money flows. You know exactly where your income is going, which expenses are necessary, and which are avoidable.

- Expense Control: With a budget, you can prevent overspending by setting limits on discretionary expenses. This helps you avoid debt accumulation and financial stress.

- Savings Goals: Budgeting allows you to allocate a portion of your income to savings. Whether for emergencies, education, or retirement, regular saving becomes achievable when planned in advance.

- Debt Management: By knowing your income and expenses, you can allocate money to pay off debts systematically, reducing interest and improving your credit score.

- Financial Security: A proper budget ensures that even during unexpected events like job loss or medical emergencies, you have funds available to meet essential needs.

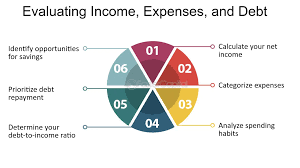

Steps to Create an Effective Budget

Creating a budget may seem complicated at first, but following a structured approach makes it manageable:

1. Calculate Your Income

Begin by determining your total income from all sources. Include your primary salary, side hustles, bonuses, or any passive income streams. It is important to consider net income (after taxes and deductions) because that is the amount available for spending.

2. Track Your Expenses

Next, list all your monthly expenses. Start with fixed expenses such as rent, utilities, loan payments, and insurance. Then, account for variable expenses like groceries, transportation, entertainment, and clothing. Tracking expenses for a few months helps identify patterns and areas where you can cut back.

3. Categorize Spending

Organizing expenses into categories provides clarity. Common categories include housing, transportation, food, entertainment, healthcare, savings, and debt repayment. Categorization allows you to analyze which areas consume most of your income and make adjustments accordingly.

4. Set Financial Goals

A budget is more effective when aligned with financial goals. Short-term goals might include saving for a vacation or paying off a credit card. Long-term goals could be purchasing a house, retirement planning, or building an emergency fund. Defining goals ensures that budgeting is purposeful rather than just restrictive.

5. Allocate Funds

After knowing your income, expenses, and goals, allocate funds to each category. Prioritize essentials first, then savings, and finally discretionary spending. The 50/30/20 rule is a common guideline: 50% of income for necessities, 30% for wants, and 20% for savings and debt repayment.

6. Monitor and Adjust

A budget is not static; it requires regular review and adjustment. Track your spending monthly and compare it with your planned budget. Adjust allocations as needed to account for changes in income, unexpected expenses, or evolving financial goals.

Common Budgeting Challenges

Budgeting can be challenging, and recognizing potential obstacles is key to overcoming them:

- Impulse Spending: Unplanned purchases can derail a budget. Avoiding impulse buying requires discipline and sometimes delaying purchases to evaluate necessity.

- Underestimating Expenses: People often underestimate variable expenses, leading to budget shortfalls. Accurate tracking is essential to prevent surprises.

- Irregular Income: Freelancers or those with inconsistent earnings may struggle to budget. In such cases, basing the budget on average monthly income or prioritizing essential expenses first can help.

- Debt Pressure: High-interest debts can consume a significant portion of income. Budgeting must prioritize debt repayment to reduce financial burden.

Tips for Successful Budgeting

- Use Technology: Budgeting apps or spreadsheets make tracking income and expenses easier and more accurate.

- Automate Savings: Automating transfers to savings or investment accounts ensures you prioritize saving before spending.

- Cut Unnecessary Expenses: Identify and reduce discretionary spending, such as dining out, subscriptions, or luxury items.

- Plan for Emergencies: Maintain an emergency fund of 3–6 months of living expenses to handle unexpected financial setbacks.

- Review Regularly: Review your budget monthly and adjust as your income, expenses, or goals change.

Types of Budgets

There are several approaches to budgeting, depending on personal preferences and financial situations:

- Zero-Based Budget: Every dollar is assigned a purpose, whether spending, saving, or investing. Income minus expenses equals zero.

- Envelope System: Cash is divided into envelopes based on spending categories. Once the envelope is empty, no more spending in that category is allowed.

- 50/30/20 Rule: Allocates 50% of income to necessities, 30% to wants, and 20% to savings and debt repayment.

- Incremental Budgeting: Uses previous month’s budget as a base and adjusts for expected changes.

The Psychological Benefits of Budgeting

Beyond financial advantages, budgeting also improves mental well-being. Knowing that your finances are under control reduces anxiety and stress. It promotes disciplined spending habits and a sense of empowerment over your life. Budgeting transforms money from a source of worry to a tool for achieving goals.

Conclusion

Budgeting is not about restricting yourself but about gaining control over your financial life. By planning income and expenses carefully, you can ensure that your money works for you rather than against you. A well-designed budget promotes savings, reduces debt, prepares you for emergencies, and helps you achieve both short-term and long-term financial goals. With discipline, consistency, and regular monitoring, budgeting becomes a powerful tool that paves the way to financial freedom and peace of mind.